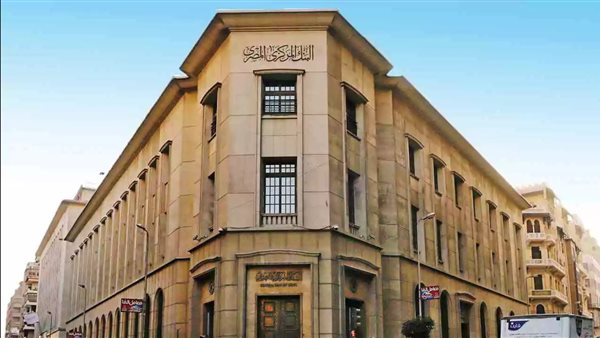

Investment banks in Egypt have differing expectations regarding the upcoming decision by the Central Bank of Egypt (CBE) on interest rates. The economic situation in Egypt remains uncertain, particularly concerning the timing of fuel price hikes and currency depreciation.

Out of the eight surveyed investment banks, half predicted that the CBE would raise interest rates by 100 to 500 basis points during its eighth and final meeting of 2023. This move aims to curb inflation, which is a priority within the economic reform program agreed upon with the International Monetary Fund (IMF). The other half of the banks expected the interest rates to remain unchanged.

During its previous meeting, the Central Bank maintained the interest rates unchanged after raising them by 1100 basis points since March 2022 when the Egyptian pound was devalued.

Sara Saada, a macroeconomic analyst at "CI Capital," anticipated that the Central Bank would keep the interest rates unchanged during the upcoming meeting but would raise them by 200 to 300 basis points early next year in an emergency meeting. She emphasized the need to provide dollar liquidity before increasing interest rates to effectively combat inflation, especially since Egypt is close to reaching an agreement with the IMF for additional financing that would secure dollars.

Egypt's inflation levels remain high, although they slowed down last month. Consumer price inflation stood at 34.6% on a year-on-year basis in the previous month, compared to 35.8% in October, mainly due to continued inflationary pressures on food and beverages, according to the Central Agency for Public Mobilization and Statistics.

Hany Amer, a macroeconomic analyst at "Arabi African International Securities," speculated that the Central Bank would maintain the interest rates unchanged during the next Monetary Policy Committee meeting. He believes that there are no significant changes that would push the Central Bank to raise interest rates at this time. However, he noted that the expected increase in energy prices, especially diesel, at the beginning of next year, which would affect all goods and services, might prompt the Central Bank to raise interest rates.

In November, Egypt raised the prices of all gasoline categories for the second time this year, while diesel prices remained unchanged. The increase in the price of the lowest-quality gasoline "80" and gasoline "92" was 1.25 Egyptian pounds per liter, while the price of gasoline "95" increased by one Egyptian pound, according to a statement from the Automatic Pricing Committee for Petroleum Products at that time.

The recent slowdown in inflation rates could be a reason to maintain the interest rates, according to Heba Monier, a macroeconomic analyst at "HC Securities." However, she stated that a formal change in the foreign exchange rate could still lead to a possibility of raising the interest rates.

Hany Genena, Chief Economist at "Cairo Capital," expects the Central Bank to raise interest rates by approximately 500 basis points in two stages. The first stage would occur during the upcoming meeting at the end of the current year, with a 300 basis points increase, followed by an additional 200 basis points raise in the first meeting of the Monetary Policy Committee in the next year.